The rate of crash coverage is based on the value of your vehicle, as well as it commonly includes a deductible of $250 to $1,000. So if your cars and truck would certainly cost $20,000 to replace, you 'd pay the first $250 to $1,000, depending upon the deductible you selected when you got your policy, and the insurer would certainly be in charge of as much as $19,000 to $19,750 after that.

In between the price of your annual premiums as well as the insurance deductible you would certainly have to pay of pocket after a crash, you can be paying a lot for really little insurance coverage. Even insurance coverage firms will tell you that going down crash protection makes good sense when your automobile is worth much less than a couple of thousand dollars.

That may be, for instance, a fire, a flood, or a falling tree. It likewise covers cars and truck burglary. Just like thorough protection, states do not need you to have collision coverage, yet if you have an auto loan or lease, your lending institution may need it. And also once more, when you have actually paid off your lending or returned your rented vehicle, you can go down the coverage.

You'll also want to take into consideration how much your auto is worth compared with the expense of covering it year after year. Uninsured/Underinsured Motorist Coverage Simply due to the fact that state laws call for motorists to have obligation insurance coverage, that does not imply every motorist does.

It can cover you and family participants if you're hurt or your cars and truck is harmed by an uninsured, underinsured, or hit-and-run motorist. Some states require drivers to carry uninsured vehicle driver coverage (UM).

If your state requires uninsured/underinsured motorist protection, you can acquire greater than the called for quantity if you wish to. You can also acquire this protection in some states that don't require it. If you aren't called for to purchase uninsured/underinsured vehicle driver protection, you might wish to consider it if the protection you currently have would want to pay the costs if you're associated with a serious accident.

A Biased View of Best Car Insurance Companies Of May 2022 - Time

cheap auto insurance cheaper cars cheap auto insurance cheap insurance

cheap auto insurance cheaper cars cheap auto insurance cheap insurance

Various Other Sorts of Protection When you're going shopping for auto insurance, you may see some other, entirely optional types of coverage. cheapest car. Those can consist of:, such as towing, if you need to rent out a cars and truck while your own is being repaired, which covers any difference between your automobile's cash money worth and what you still owe on a lease or funding if your automobile is a failure Whether you need any one of those will certainly rely on what various other resources you have (such as subscription in a car club) as well as exactly how much you could pay for to pay out of pocket if you must.

Whether to acquire greater than the minimum required protection as well as which optional kinds of protection to take into consideration will certainly depend on the assets you need to safeguard along with just how much you can afford to pay. Your state's automobile department site must describe its requirements as well as may use various other suggestions certain to your state - cheapest car.

Having the right info in hand can make it simpler to get an accurate cars and truck insurance quote. You'll desire to have: Your driver's certificate number Your automobile recognition number (VIN) The physical address where your automobile will certainly be kept You might likewise wish to do a little research study on the types of coverages offered to you.

Insurance policy service providers wish to see shown liable behavior, which is why website traffic crashes and also citations are factors in determining cars and truck insurance coverage rates (laws). Keep in mind that directs on your license do not remain there permanently, however how much time they remain on your driving document varies depending upon the state you stay in as well as the seriousness of the offense.

For example, a brand-new cars will likely be extra costly than, state, a five-year-old sedan. If you pick a reduced insurance deductible, it will certainly lead to a higher insurance policy costs that makes choosing a greater insurance deductible appear like a respectable bargain. A greater insurance deductible could indicate paying more out of pocket in the occasion of a mishap.

What is the typical vehicle insurance price? There are a vast selection of aspects that affect just how much auto insurance coverage prices, which makes it challenging to obtain an exact suggestion of what the average person spends for car insurance policy. According to the American Car Organization (AAA), the average price to insure a sedan in 2016 was $1222 a year, or approximately $102 monthly.

All About State Auto Insurance

How do I obtain cars and truck insurance coverage? Getting a car insurance coverage price quote from Nationwide has never been easier - liability.

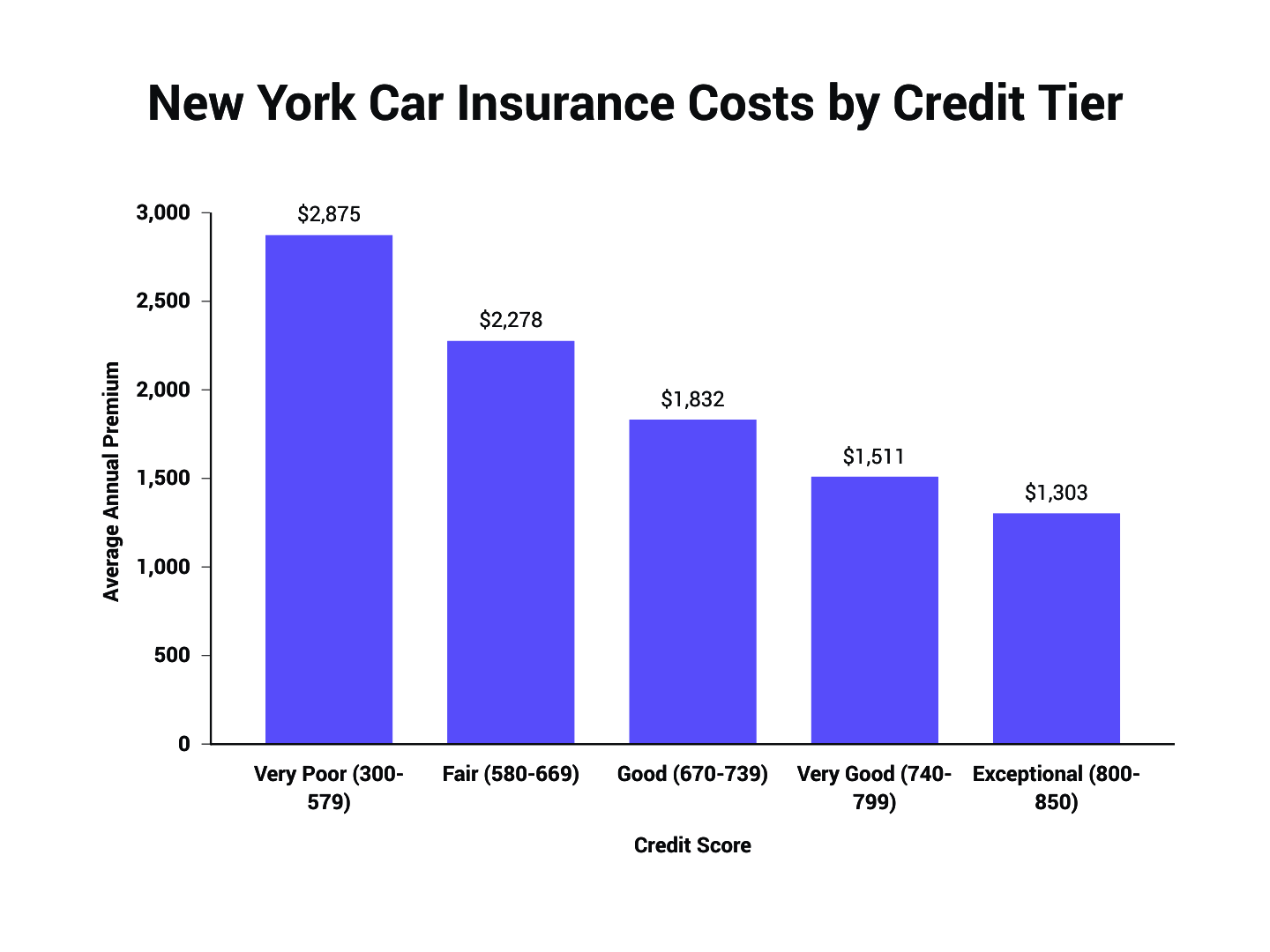

In others, having poor credit history can create the price of your insurance costs to rise dramatically. Not every state allows insurers to make use of the gender listed on your driver's certificate as an establishing consider your premiums. But in ones that do, female vehicle drivers usually pay a little much less for insurance policy than male vehicle drivers.

Why Do Car Insurance Policy Prices Change? Looking at average car insurance policy rates by age and state makes you wonder, what else affects rates?

An at-fault mishap can increase your rate as a lot as 50 percent over the next three years. In general, cars and truck insurance coverage often tends to get extra pricey as time goes on.

cheaper suvs dui vehicle

cheaper suvs dui vehicle

There are a number of various other price cuts that you might be able to utilize on right currently (cheap). Here are a few of them: Numerous companies provide you the greatest discount rate for having a good driving background. Additionally called packing, you can get lower rates for holding greater than one insurance coverage with the exact same business.

/car-repair-following-insurance-claim-accident-527113_color-e5cd60eaed274db5b5e65c860183cd64.png) suvs car accident cheap insurance

suvs car accident cheap insurance

House owner: If you own a residence, you could get a homeowner discount from a variety of providers. affordable auto insurance. Get a discount for sticking with the very same firm for multiple years. Below's a trick: You can constantly compare rates each term to see if you're getting the very best price, despite your loyalty price cut.

Get This Report about Car Insurance - Get An Auto Insurance Quote - Allstate

Nonetheless, some can additionally increase your rates if it transforms out you're not a good driver. Some companies offer you a discount for having a good credit history score - low cost auto. When browsing for a quote, it's a good concept to call the insurer and ask if there are anymore discount rates that apply to you.

You're regarding to relocate: Where you live is a vital aspect in determining your rates. Your credit rating have transformed substantially: Car insurance provider with the exemption of those in California, Hawaii, Maryland and also Massachusetts consider your credit report when setting your price. Your driving background has actually enhanced: If it's been awhile since your last accident or driving infraction, your rate might improve (auto).

Your driving routine has actually transformed: If you're driving less miles these days or no longer commuting for job, you may wish to shop around to see if you can get a reduced rate (business insurance).

In others, having negative credit can cause the price of your insurance coverage premiums to climb considerably. Not every state allows insurance firms to utilize the gender noted on your vehicle driver's license as an identifying aspect in your premiums. In ones that do, women drivers commonly pay a little less for insurance policy than male chauffeurs - cheapest car insurance.

Why Do Automobile Insurance Policy Rates Modification? Looking at ordinary car insurance policy rates Helpful resources by age and state makes you question, what else impacts rates?

An at-fault mishap can increase your rate as much as 50 percent over the next three years. Generally, cars and truck insurance often tends to get extra costly as time goes on.

Not known Facts About Average Car Insurance Costs In 2022 - Nerdwallet

There are a number of other discount rates that you might be able to take advantage of on right currently. Here are a few of them: Many firms offer you the greatest price cut for having an excellent driving history. cheaper car. Likewise called bundling, you can obtain lower prices for holding greater than one insurance coverage plan with the exact same company.

House owner: If you have a home, you might obtain a house owner discount from a variety of carriers. Obtain a discount for sticking with the same company for numerous years. Right here's a trick: You can always contrast prices each term to see if you're obtaining the best rate, despite having your commitment discount rate.

Nevertheless, some can also elevate your prices if it ends up you're not a good chauffeur. Some firms offer you a discount rate for having a great credit scores rating. When looking for a quote, it's a good idea to call the insurance provider and ask if there are anymore discounts that put on you.

You will move: Where you live is an essential aspect in identifying your prices. Your credit rating have actually altered substantially: Automobile insurance provider with the exemption of those in California, Hawaii, Maryland and Massachusetts consider your credit rating when establishing your price. Your driving history has actually improved: If it's been awhile given that your last mishap or driving violation, your price might boost.

Your driving regimen has changed: If you're driving less miles these days or no more commuting for job, you may intend to search to see if you can obtain a lower rate (affordable).

However in others, having poor credit history could cause the cost of your insurance policy costs to climb drastically. Not every state permits insurance companies to utilize the gender provided on your chauffeur's license as a figuring out consider your premiums. In ones that do, women drivers generally pay a little less for insurance coverage than male drivers.

The Ultimate Guide To Best Car Insurance Companies Of May 2022 – Forbes Advisor

Plans that only meet state minimum insurance coverage demands will be the most affordable. cheap. Additional insurance coverage will set you back even more. Why Do Auto Insurance Policy Prices Change? Checking out average vehicle insurance policy prices by age and state makes you ask yourself, what else affects prices? The response is that vehicle insurance coverage rates can transform for lots of factors.

An at-fault crash can elevate your rate as much as 50 percent over the next three years. On the whole, auto insurance coverage tends to get extra costly as time goes on.

There are a number of various other discount rates that you may be able to exploit on right currently. Right here are a few of them: Several business give you the greatest discount for having an excellent driving background. Called bundling, you can obtain lower prices for holding more than one insurance coverage policy with the same business (insure).

cheapest car affordable low cost auto credit score

cheapest car affordable low cost auto credit score

House owner: If you have a home, you can obtain a home owner price cut from a variety of carriers. Obtain a price cut for sticking to the exact same firm for multiple years. vehicle insurance. Right here's a key: You can constantly compare prices each term to see if you're getting the very best rate, even with your loyalty discount rate.

Nevertheless, some can likewise elevate your prices if it turns out you're not a good vehicle driver. Some business provide you a price cut for having a good credit rating. When searching for a quote, it's a good idea to call the insurance firm as well as ask if there are any kind of even more discount rates that relate to you.

You're concerning to move: Where you live is an important consider establishing your prices. Your credit history have altered considerably: Auto insurance coverage firms with the exemption of those in California, Hawaii, Maryland as well as Massachusetts consider your credit rating when setting your rate. Your motoring history has actually enhanced: If it's been awhile considering that your last accident or driving violation, your rate may enhance.

Little Known Facts About What Is The Average Cost Of Car Insurance? - Money Helper.

Your driving routine has altered: If you're driving less miles nowadays or no more commuting for job, you might want to search to see if you can get a reduced rate.